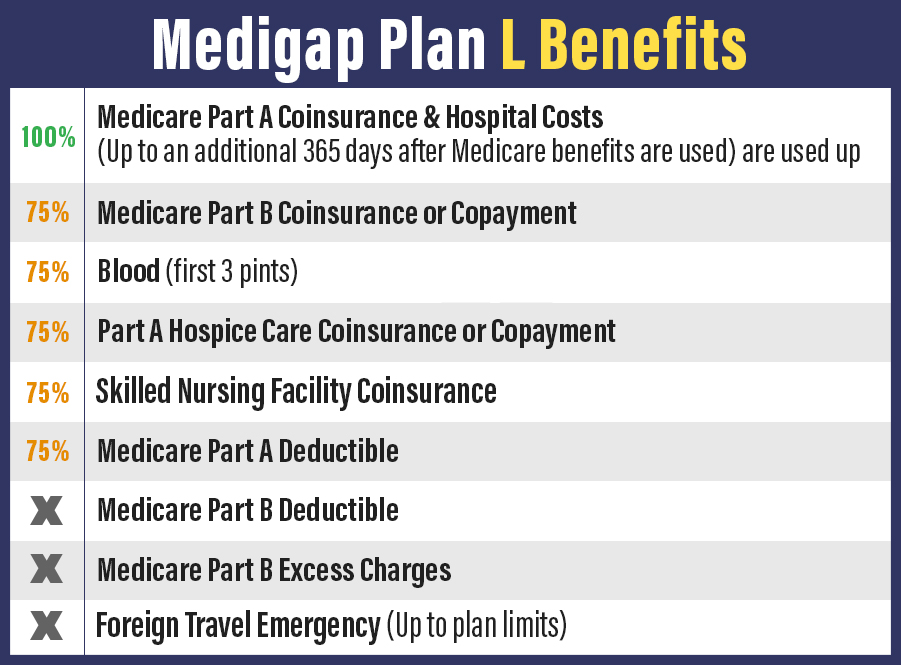

Medicare Supplement Plan L

Medigap Plan L not only covers a percentage of your out-of-pocket expenses left over by Original Medicare, but it also features an annual out-of-pocket maximum limit of $2,780 (in 2019).

Plan L is only one of two Medicare Supplement insurance policies that feature this out-of-pocket limit. Because of this popular feature and lower premiums, it may be worth the extra cost-sharing for Medicare beneficiaries.

What does Medigap Plan L cover?

Along with the out-of-pocket maximum ($2,780 in 2019), Medicare Supplement Plan L also features 75% coverage of these benefits:- Medicare Part B coinsurance or copayment

- Part A hospice care coinsurance or copayment

- Medicare Part A deductible

- First three pints of blood used in a medical procedure

- Skilled nursing facility care coinsurance

Request Medigap Plans Quotes

Get a Free Consultation about about Medicare Plans

Medicare Supplement Plan L out-of-pocket costs

Under Plan L, you’ll pay some out-of-pocket costs associated with Medicare. These costs could be:- Medicare Part B deductible

- Medicare Part B excess charges

- Foreign travel emergency