Figure out your enrollment periods

If you’re about to become Medicare eligible, you need to make some decisions about your health care coverage. This is because if you wait to enroll until after the initial enrollment period, you may have to pay a penalty and there may be a gap in your coverage.

Once you’ve decided what parts of Medicare you would like to enroll in, it’s time to figure out when your plan’s enrollment period is.

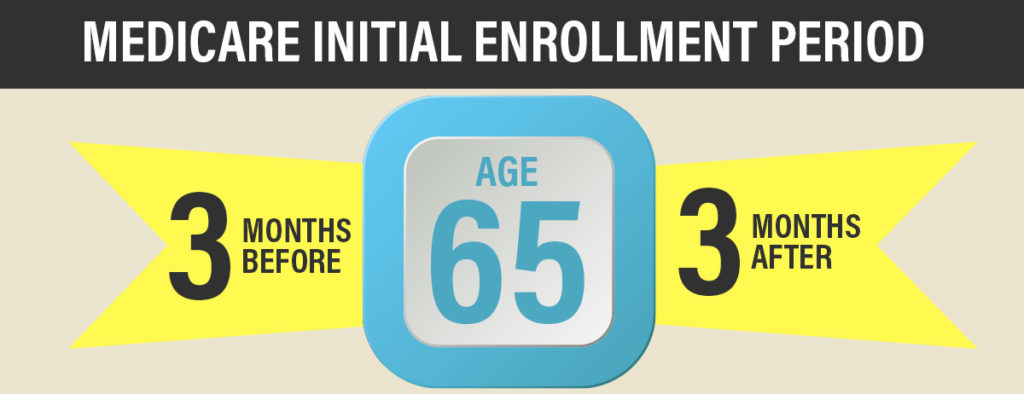

When is the Medicare Initial Enrollment Period?

Your initial enrollment period begins three months before the month of your 65th birthday and ends three months after your 65th birthday month.

This Happens With One Exception: if your birthday is on the first of the month. This will cause your enrollment period to begin one month early. For example: if your birthday is October 1, your enrollment period will begin June 1 and your Medicare will begin one month early as well — September 1.

During your initial enrollment period, you can enroll in Original Medicare (Part A and B), Medicare Advantage plan, or Medicare Part D.

When is Medigap’s open enrollment period?

Once you are enrolled in Medicare Part A and B, there is a six-month open enrollment period for Medigap (Medicare Supplement) plans. This window begins with your Part B effective date and is a one-time election period.

I missed my Medicare enrollment period

If you miss your initial enrollment period, there are a few penalties you’ll face. However, these only apply if you do not have any other coverage, such as employer coverage.

The penalties are as follows:

If you do not enroll in Part B during initial enrollment, you’ll pay a late enrollment penalty. The penalty is an extra 10% of your premium for every 12-month period you should have had Part B. That 10% is tacked on each month for as long as you have coverage.

If you don’t have Part D coverage and miss your enrollment period, you’ll pay a late enrollment penalty. The penalty is an extra 1% of your premium for as long as you have coverage.

Should you not qualify for free Part A coverage because you didn’t work long enough and you miss your enrollment period, you’ll pay an extra 10% of your premium for twice the number of years you didn’t have coverage.

What if I have employer coverage?

Many people work beyond age 65 and would like to continue their employer coverage instead of signing up for Medicare. This is fine and you will not be penalized. When you do retire, you will be able to sign up for Medicare during a Special Enrollment Period.

This enrollment period is eight months long that begins either the month you or your spouse quits working or the month your group coverage ends, whichever comes first.

What is a Medicare Special Enrollment Period?

There are a couple situations that allow you to enroll into Medicare during a Special Enrollment Period.

As discussed above, if you work beyond age 65 and have employer-provided health coverage that you would like to continue instead of Medicare, you are allowed to delay enrollment without penalty.

Another example would be if you move outside of a plan’s service area. This would trigger a two-month enrollment period in which you could switch to a new Medicare Advantage or Part D prescription drug plan. You could also return to Original Medicare without penalty. Sometimes, you can also enroll into Medigap.

There are other unique situations in which you may also be eligible for a special enrollment period. You are welcome to contact us to learn what options are available for you.

When can I enroll in Medicare Advantage or Medicare Part D?

The annual enrollment period for Medicare Part C and D begins October 15 and December 7 each year.

If you miss this period, you can join during the next year’s annual enrollment period.

During annual enrollment, you can switch to Medicare Advantage from Original Medicare. You can also switch Medicare Advantage plans and Part D plans.