Medicare Supplement Plan K

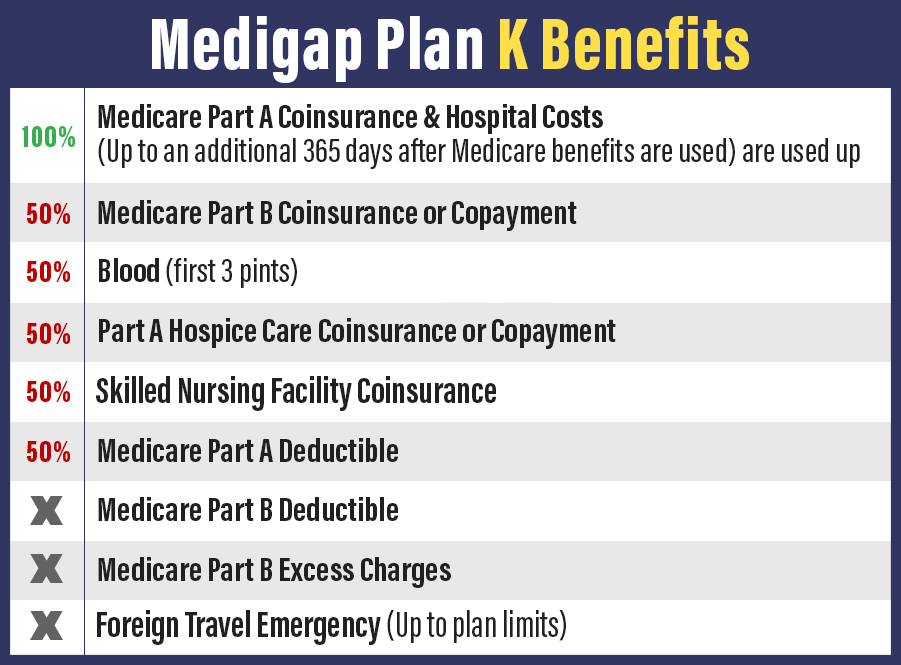

Medicare Supplement Plan K is the Medigap plan that covers Original Medicare’s hospital deductible and 50% of coinsurance and copayment expenses.

What does Medicare Supplement Plan K cover?

Medigap Plan K includes a yearly out-of-pocket limit of $5,560. This is huge because Original Medicare does not feature this benefit. So, if you were to reach your out-of-pocket limit, Medigap Plan K may cover 100% of your Medicare-covered costs for the rest of the year.

Medicare Supplement Plan K also covers 50% of these expenses left over from Original Medicare:

- Medicare Part A deductible

- Medicare Part A hospice care coinsurance or copay

- Skilled nursing facility care coinsurance

- Medicare Part B copayment or coinsurance

- First three pints of blood for a covered medical procedure

It does not cover Part B’s deductible, excess charges, or a foreign travel emergency.

Lots of Medicare beneficiaries elect to purchase Plan K because of its lower premiums. If you do not make lots of trips to the doctor’s office or hospital, it may be worth sharing some of the medical costs to save on monthly premiums.

A licensed Medicare agent with Strickland Insurance can evaluate your situation for free and offer you a plan suited for your budget and medical needs.

Request Medigap Plans Quotes

Get a Free Consultation about about Medicare Plans

What is the out-of-pocket maximum for Medigap Plan K?

The maximum out-of-pocket limit for Medigap Plan K is $5,240 in 2019. This is the most you will have to pay out of your own pocket for Medicare-related expenses in a single year. If you were to ever hit this limit, your Medicare Supplement has to cover 100% of your Medicare-related expenses for the rest of the year. Because of this maximum, lots of Medicare beneficiaries will take the lower premiums offered by Plan K, knowing if they were to ever have a major health issue, the out-of-pocket limit offers a ceiling for their expenses.

Medicare Supplement Insurance Quotes

If you are interested in Medigap Plan K or any other Medicare Supplement Insurance plan, a licensed Medicare agent at Strickland Insurance will be happy to shop for a good rate and offer consultation services so you feel comfortable in your decision on a policy.