Medicare Supplement Plan G

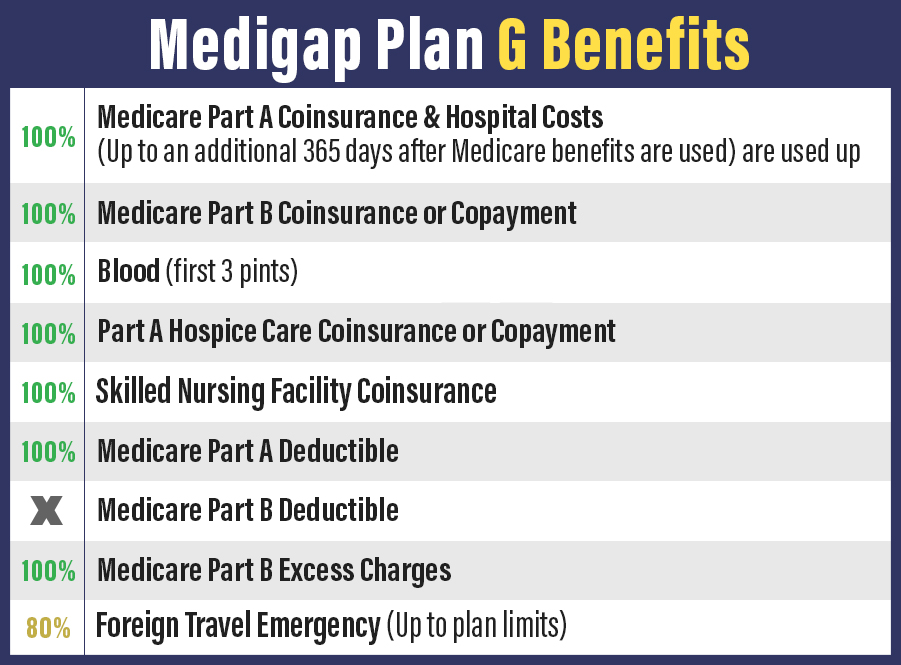

Medigap Plan G offers the second-best coverage in the Medicare Supplement realm making it the second-most popular plan among Medicare beneficiaries. It covers all the gaps in Original Medicare other than Part B’s deductible.

What does Medigap Plan G cover?

Medicare Supplement Plan G covers almost every out-of-pocket expense left behind by Original Medicare, including:- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- First three pints of blood used in an approved medical procedure

- Part A hospice care coinsurance or copayment

- Skilled nursing facility coinsurance

- Medicare Part A deductible

- Medicare Part B excess charges

- Foreign travel emergency

Request Medigap Plans Quotes

Get a Free Consultation about about Medicare Plans

Medicare Plan G deductible

A lot of people mistakenly think Medicare Supplement Plan G has a deductible. Actually, the deductible you are paying is Medicare Part B’s outpatient care deductible, which is $185 in 2019. After that deductible, Medigap Plan G covers all remaining expenses.

If you can find a Plan G plan quite a bit cheaper than Plan F in your area, it might make more sense financially to choose Plan G due to savings.

This is because Plan B’s deductible is only paid once annually. So, if your premium for Plan G is more than $15 cheaper than Plan F, you will be saving money.

A licensed Medicare agent with Strickland Insurance would be happy to shop medicare supplement plans for you.

Does Plan F or Plan G offer more coverage?

Technically, both plans offer the same amount of coverage. The only difference in these two popular Medicare Supplements is that you pay Medicare Plan B’s deductible once per year. However, because Plan G has a lower monthly premium, you may actually save money!

Reach out to one of us at Strickland Insurance to see how you can take care of almost all of your out-of-pocket Medicare expenses and save money today!