Healthcare coverage plans difference

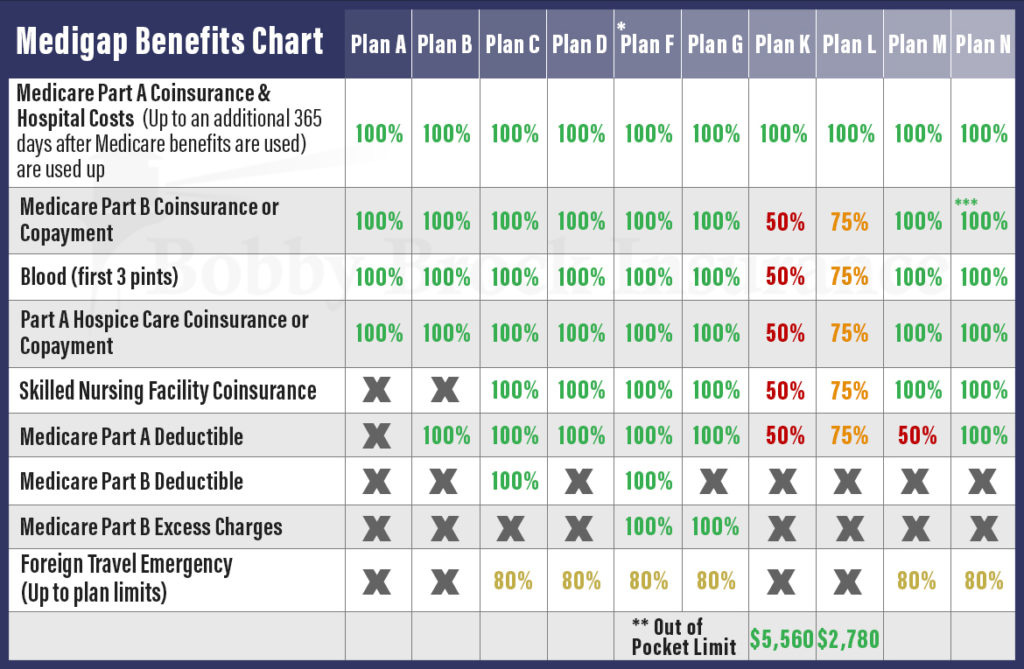

There are 10 Medicare Supplement Insurance plans lettered A through N. Each plan differs in the amount of coverage provided for the “gaps” left behind by Original Medicare.

Medicare Supplement plans, also known as Medigap plans, are offered by private insurance companies licensed by Medicare. Each is required by Medicare to have standardized coverage and plan letters no matter which insurance company you purchase them from. The only difference you’ll find among plans is price of premium.

We have broken down the coverage of each Medigap plan below so you can make an informed decision about your healthcare coverage.

Which Medicare Supplement Plan is the best?

As you can see from the chart below, Medicare Supplement Plan F provides the most comprehensive coverage. Plan F covers:- Original Medicare Part A’s deductible

- Part B deductible

- Part B excess charges

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare’s benefits are all used up

- Part B coinsurance or copayments

- First three pints of blood used in an approved medical procedure

- Skilled nursing facility coinsurance

- 80% of a foreign travel emergency (up to plan limits)

Get Medicare Help from an Expert

If you see a plan above that seems like a good fit for you, or you need more help deciding, give one of our licensed Medicare agents a call and we can help you find a plan to fit your budget and healthcare needs!Medicare Supplement Plan Quotes

Get a Free Consultation about about Medicare Plans